- November 16, 2024

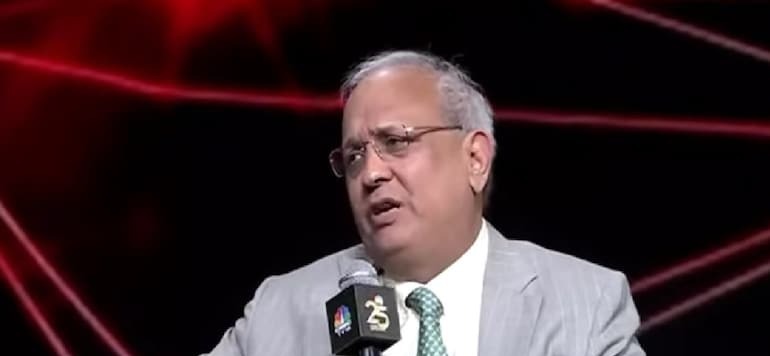

FIIs are mostly done with selling in Indian markets, says Samir Arora of Helios

In a key statement reflecting the current mood in India’s stock markets, Samir Arora, the founder and fund manager of Helios Capital, recently remarked that Foreign Institutional Investors (FIIs) are “mostly done with selling” in Indian equities. His assertion provides significant insight into the shifting dynamics of foreign investment in India, especially given the substantial impact FIIs have on the Indian stock market. Over the past few years, FIIs have been pivotal players, with their buying and selling activities significantly influencing market movements. Arora’s comments suggest that the period of aggressive selling by FIIs in the Indian market may be coming to an end, indicating a potential stabilization of foreign investment flows into India. This shift could have profound implications for the Indian market’s future trajectory, especially considering the ongoing concerns around global economic uncertainties, inflationary pressures, and tightening monetary policies. Foreign Institutional Investors, or FIIs, are major contributors to liquidity in emerging market economies like India. These investors typically include foreign banks, mutual funds, pension funds, hedge funds, and other large financial institutions that deploy capital into Indian equities, debt markets, and other asset classes. Over the years, India has become one of the most attractive destinations for FIIs due to its strong growth prospects, robust economic fundamentals, and improving corporate governance standards. However, the dynamics of FII flows have not always been consistent. While FIIs were major net buyers during the early years of India’s economic reforms and market liberalization, their behavior has been more volatile in recent years, particularly in light of global economic developments. In 2022 and 2023, the Indian stock market saw significant bouts of selling by FIIs, driven by a combination of global inflationary pressures, rising interest rates in developed markets, and fears of an impending recession. This led to concerns among market participants about the sustainability of India’s equity market rally, which had been largely fueled by domestic retail investors. Samir Arora, a seasoned fund manager with over two decades of experience, has a unique perspective on the ebb and flow of foreign investments in India. According to Arora, the significant selling spree by FIIs in the Indian markets appears to be largely over. He believes that the foreign selling pressure that dominated the market in recent years is now fading, with FIIs having largely “done with selling.” This comment is particularly timely, as it comes at a point when India’s markets have been experiencing a period of relative stability and even upward momentum despite the broader global challenges. Arora’s viewpoint hinges on the broader macroeconomic picture. The global economy has been grappling with high inflation and aggressive monetary tightening by central banks, especially the US Federal Reserve. These factors led to a substantial outflow of foreign capital from emerging markets like India, as investors sought refuge in safe-haven assets such as the US dollar, US government bonds, and gold. The tightening of liquidity in the global economy, coupled with concerns about geopolitical tensions, had prompted FIIs to reduce their exposure to riskier assets, including Indian stocks. However, Arora suggests that the worst of this phase may now be behind us. Several factors may be contributing to the stabilization of FII sentiment towards the Indian market, as outlined by Arora. Firstly, India’s macroeconomic fundamentals remain relatively strong compared to many other emerging markets. While inflation and global supply chain disruptions have posed challenges, India’s economic growth trajectory has remained resilient. The country’s GDP growth has been among the highest in the world, supported by a young and growing population, a burgeoning middle class, and ongoing structural reforms in sectors like agriculture, manufacturing, and infrastructure. These long-term growth drivers continue to make India an attractive destination for foreign investors.

The post FIIs are mostly done with selling in Indian markets, says Samir Arora of Helios first appeared on InfluencersPro.